Updated July 28, 2021 to include the new SBA PPP Direct Forgiveness Portal. This 3508EZ PPP Forgiveness Application form may be used by businesses with PPP loans of more than $150,000 who qualify based on SBA requirements we’ll discuss in a moment. It’s designed to be more streamlined than the full forgiveness application form 3508. The SBA updated the PPP Loan Forgiveness Application Form 3508EZ on January 16, 2021. Make sure you are using the latest version .

The material contained in this article is for informational purposes only, is general in nature, and should not be relied upon or construed as a legal opinion or legal advice. Please keep in mind this information is changing rapidly and is based on our current understanding of the programs. It can and likely will change. Although we will be monitoring and updating this as new information becomes available, please do not rely solely on this for your financial decisions. We encourage you to consult with your lawyers, CPAs and Financial Advisors.

While applying for forgiveness may still seem daunting—- even with this simper form— the 3508EZ form requires fewer calculations and less documentation for eligible borrowers than the full forgiveness application. Here we’ll walk through the application. If you have questions that aren’t answered on the application itself you may find answers in the SBA guidance.

The SBA is launching a new online SBA PPP Direct Forgiveness portal to allow borrowers with loans of $150,000 or less to apply for forgiveness directly with the SBA.

The 3508EZ form is designed for businesses that borrowed more than $150,000 for their first or second draw PPP loan and who meet at least one of the following criteria:

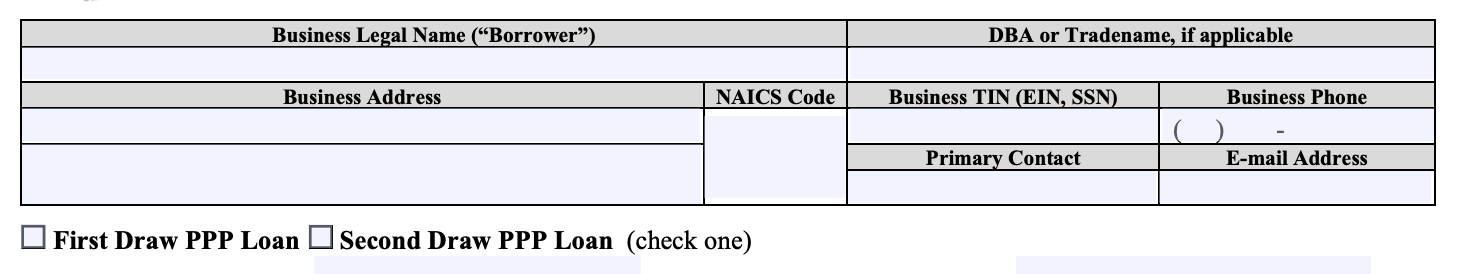

If you plan to use this form to qualify for forgiveness, we recommend you print out the PPP Forgiveness Application Form 3508EZ and follow along here. Your lender may use an electronic version of this form but if you have it handy, it won’t hurt to have this information already filled out. First fill out basic information about your business. Unless your business address has changed, this should be the same as the information you used when you applied for PPP: If this is your first PPP loan, check the box that says First Draw PPP Loan. If it’s your second PPP loan, check the box that says Second Draw PPP Loan. Note: You must submit a forgiveness application for your first PPP loan before, or at the same time, as the second draw forgiveness application is submitted. SBA PPP Loan Number: ________________________This is the number assigned by the SBA to your loan. If you don’t have it, ask your lender.Lender PPP Loan Number: __________________________Enter the loan number assigned to the PPP loan by the Lender. Again, if you don’t know, ask your lender.PPP Loan Amount: _____________________________This is the amount you received.PPP Loan Disbursement Date: _______________________Again, this is when the funds were deposited in your bank account. If you received more than one disbursement, use the date of the first one.Employees at Time of Loan Application: ___________ Enter the total number of employees at the time of the Borrower’s PPP Loan Application. Employees at Time of Forgiveness Application: ___________ Enter the total number of employees at the time the borrower is applying for loan forgiveness. Check the box if the Borrower, together with its affiliates (to the extent required under SBA’s interim final rule on affiliates (85 FR 20817 (April 15, 2020)) and not waived under 15 U.S.C. 636(a)(36)(D)(iv)), received PPP loans with an original principal amount in excess of $2 million. If you received more than $2 million (with affiliates) make sure you review this with your advisors.Forgiveness Amount Calculations Payroll and Nonpayroll Costs Line 1: Payroll CostsEmployee Benefits: The total amount paid by the Borrower for:

Owner Compensation: Any amounts paid to owners (owner-employees (with an ownership stake of 5% or more), a self employed individual, or general partners). For each individual owner in total across all businesses, this amount is capped at

(a) $20,833 (the 2.5-month equivalent of $100,000 per year), or

(b) the 2.5-month equivalent of the individual’s applicable compensation in the year that was used to calculate the loan amount (2019 or 2020), whichever is lower.

Nonpayroll Costs

Next, you’ll fill out information about nonpayroll costs. You only need to include these if you want to apply for forgiveness for these amounts. If you qualify for full forgiveness based on payroll costs and/or you don’t want to apply for forgiveness based on nonpayroll costs, you can put 0 in Lines 2-8.

Eligible nonpayroll costs cannot exceed 40% of the total forgiveness amount. Count nonpayroll costs that were both paid and incurred only once.

Line 2. Business Mortgage Interest Payments:_______

Enter the amount of business mortgage interest payments (not including any prepayment or payment of principal) paid or incurred during the covered period for any business mortgage obligation on real or personal property incurred before February 15, 2020. Do not include prepayments.

Line 3. Business Rent or Lease Payments: ______

Enter the amount of business rent or lease payments paid or incurred for real or personal property during the covered period, pursuant to lease agreements in force before February 15, 2020.

Line 4. Business Utility Payments:______

Enter the amount of business utility payments (business payments for a service for the distribution of electricity, gas, water, telephone, transportation, or internet access) paid or incurred during the covered period, for business utilities for which service began before February 15, 2020.

Line 5. Covered Operations Expenditures: _____________________

Enter the amount of covered operations expenditures paid or incurred during the covered period. The application defines these as “payments for any business software or cloud computing service that facilitates business operations, product or service delivery, the processing, payment, or tracking of payroll expenses, human resources, sales and billing functions, or accounting of tracking of supplies, inventory, records, and expenses.”

Line 6. Covered Property Damage Costs: _____________________

Enter the amount of covered property damage costs paid or incurred during the covered period. The application defines these as “costs related to property damage and vandalism or looting due to public disturbances that occurred during 2020 that were not covered by insurance or other compensation.”

Line 7. Covered Supplier Costs: _____________________

Enter the amount of covered supplier costs paid or incurred during the covered period. These are defined in the application as “expenditures made to a supplier of goods for the supply of goods that are essential to the operations of the borrower at the time at which the expenditure is made, and made pursuant to a contract, order, or purchase order in effect prior to the beginning of the covered period (for perishable goods, the contract, order, or purchase order may have been in effect before or at any time during the covered period).”

Line 8. Covered Worker Protection Expenditures:________________

Enter the amount of covered worker protection expenditures paid or incurred during the covered period. These are defined in the application as “operating or capital expenditures that facilitate the adaptation of the business activities of an entity to comply with the requirements established or guidance issued by the Department of Health and Human Services, the Centers for Disease Control, or the Occupational Safety and Health Administration, or any equivalent requirements established or guidance issued by a State or local government, during the period starting March 1, 2020 and ending on the date on which the national emergency declared by the President with respect to the Coronavirus Disease 2019 (COVID-19) expires related to maintenance standards for sanitation, social distancing, or any other worker or customer safety requirement related to COVID-19, but does not include residential real property or intangible property.”

Potential Forgiveness Amounts

Now comes the fun part. You get to find out whether you qualify for full forgiveness. Hopefully you will!

Line 9. Sum the amounts on lines 1-8: ________

Line 10. PPP Loan Amount: _______

Line 11. Payroll Cost 60% Requirement (divide Line 1 by 0.60): _____

Divide (don’t multiply!) the amount on line 1 by 0.60, and enter the amount. This determines whether at least 60% of the potential forgiveness amount was used for payroll costs.

Forgiveness Amount

Line 12. Forgiveness Amount (enter the smallest of Lines 9, 10, and 11): _______

That’s the end of the calculation. Congratulations!

Unfortunately, we’re not done yet. There are three more parts to the application:

There is a full list of certifications on page two of the application that the borrower will need to initial. We won’t repeat them all here but you should read them carefully and if you have any questions about whether you can answer them affirmatively, talk to your attorney or tax professional.

Certain documentation will have to be included with your forgiveness application. You can find the documentation requirements starting on page 4 of the application form.

You must retain required documents for six years after the date the loan is forgiven or repaid in full, and permit authorized representatives of SBA, including representatives of its Office of Inspector General, to access such files upon request. Keep good records!

This article was originally written on June 17, 2020 and updated on December 14, 2021.

This article currently has 127 ratings with an average of 4.5 stars.